Upgrade from MYOB AssetManager or AssetManager Pro

Still using MYOB AssetManager v1, v2 or v3 or an older version of AssetManager Pro?

Upgrade to the current release of AssetManager Pro

Run AssetManager Pro on the latest Windows and MS Server

Full support for Windows 8/8.1/10/11 and MS Server 2008(R2)/2012(R2)/2016/2019 and Remote Desktop (Terminal Services)

| Benefit | Details | v1 | v2 | v3 | Current Release |

|---|---|---|---|---|---|

| Latest Windows OS | Run AssetManager Pro on Windows 8/8.1/10 | ✓ | |||

| MS Server and Remote Access | Install and run AssetManager Pro from your centralized MS Server (Remote Access via Terminal Services)

Available with Premier, Enterprise and Advisor Editions |

✓ | |||

| High-DPI Touch Screens | Use AssetManager Pro on High-DPI Touchscreens | ✓ |

Get Compliant

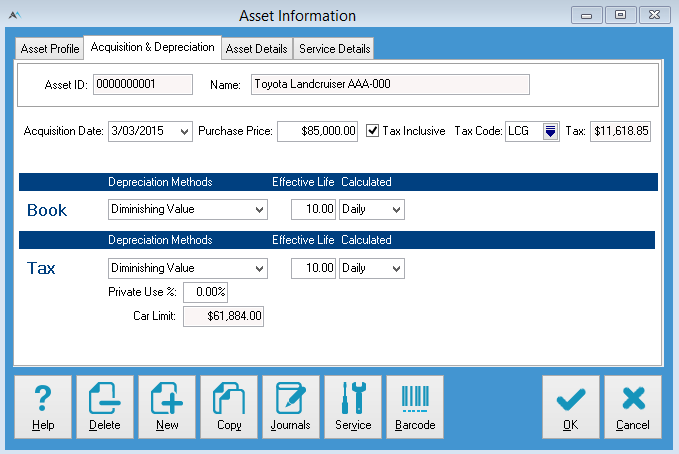

Ensure you are fully complaint with the Australian Tax Office for your Book AND Tax Asset Depreciation, Transactions and Asset Pools

| v1 | v2 | v3 | Current Release | ||

|---|---|---|---|---|---|

| Simplified Tax System (Small Business Entities) |

Running a Small Business Entity? Ensure you are up to date with the latest write-off and accelerated depreciation rules | ✓ | |||

| Motor Vehicle Cost Limits | Comply with ATO rules around the cost limit you can depreciate on for Motor Vehicles | ✓ | |||

| GST/LCT | Application of GST and LCT to ensure correct application of depreciation and asset transactions | ✓ | |||

| Asset Pools | Full support and up to date rates for Low Value, Long Life, General SBE and Software Development Pools | ✓ | |||

| Diminishing Value Depreciation (Assets acquired on/after 10th of May 2006) | Ensure you are depreciating diminishing value assets acquired on or after the 10th May 2006 at 200% (not 150%) | ✓ | |||

| Uniform Capital Allowance | Still using AssetManager v1 and % Rates? move to correctly define the depreciation rate of an Asset as an effective life in line with the Uniform Capital Allowance Rules introduced in 2001. | ✓ | |||

| Effective Life | Ensure you are setting an asset depreciation based on effective life (NOT rate) | ✓ |

Enhanced Asset Tracking

Use AssetManager Pro for more than an Asset Register.

Track key Asset Properties, Count and Reconcile your Assets and their Location and keep track of Service and Warranty History

| Benefit | v1 | v2 | v3 | Current Release | |

|---|---|---|---|---|---|

| Insurance Tracking | Details of the insurance company, policy number, insured value and premium. You can generate reports on insurance costs, compare insured values to current values, and ensure your insurance expenses are under control. You can also see when premiums are due, and what total amounts are payable. | ✓ | |||

| Asset Bar-coding |

Print barcodes for your assets and their locations. Customise the barcode output to fit your labels *requires additional module |

✓ | |||

| Custom Asset Property Fields |

Enhanced asset classification with 6 custom fields including drop down lists and entry fields. | ✓ | |||

| Warranty Details | Tracking Serial Numbers, Warranty Dates and Expiring Warranties | ✓ |

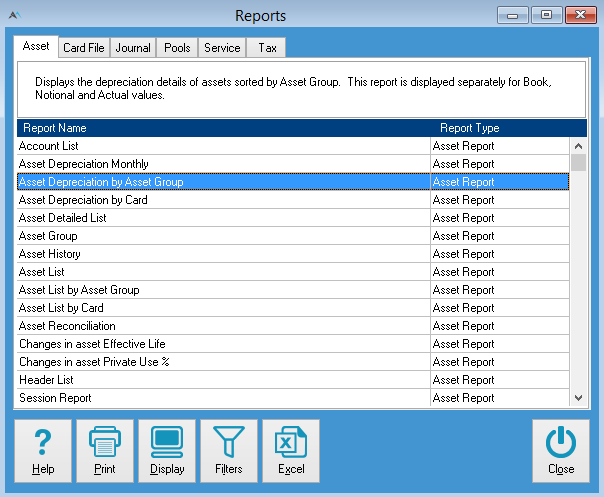

Enhanced Asset Lists and Reporting

Get the most out of AssetManager Pro with enhanced reporting and searching

| Benefit | v1 | v2 | v3 | Current Release | |

|---|---|---|---|---|---|

| Reports | Access to an amazing array of reports on Asset Details, Depreciation, Asset Transactions, Journals and Cards |

16 Reports | 29 Reports | 29 Reports | 52 Reports |

| Formatted Excel Outputs | Designed for Excel report outputs making it easy to analyze key data | ✓ | |||

| Dynamic Asset Register/List | Search Sort and Group Assets by 14 different views. Search for Assets by ID and Name | ✓ |

An Edition for your Needs

Upgrading from an earlier version of AssetManager Pro?

| Business | Premier | Enterprise | Advisor | ||

|---|---|---|---|---|---|

| Support Plan INCLUDED | 12 Months of Technical Support 12 Months of Free Upgrades |

||||

| Number of Company Files | Number of company files you manage | 2 | 10 | 100 | UNLIMITED |

| MS Server Support | MS Server 2008(R2)/2012(R2)/2016 Remote Access (Terminal Services) |

||||

| UPGRADE PRICE | Price (Includes 12 Months Support) | $715 AUD | $964 AUD | $1213 AUD | $1710 AUD |

| NOT FOR PROFIT DISCOUNT | 20% | 20% | 20% | 20% |

Family Upgrades

Are you an existing AssetManager Pro customer and need more company files and/or want to run AssetManager Pro on MS Server.Upgrade from your current edition to Premier, Enterprise or Adviser Editions.

| To Edition | Company Files | From business edition | From premier edition | From enterprise edition |

|---|---|---|---|---|

| AssetManager Pro Premier Edition | 10 Company Files | $550 AUD | N/A | N/A |

| AssetManager Pro Enterprise Edition | 100 Company Files | $1,100 AUD | $550 AUD | N/A |

| AssetManager Pro Advisor Edition | Unlimited Company Files | $2,200 AUD | $1,650 AUD | $1,100 AUD |

Upgrade directly from v3 using the EASY UPGRADE ASSISTANT

Upgrading your data from v1 and v2 let us migrate it ($300 inc GST per file)

All prices in AUD and including GST